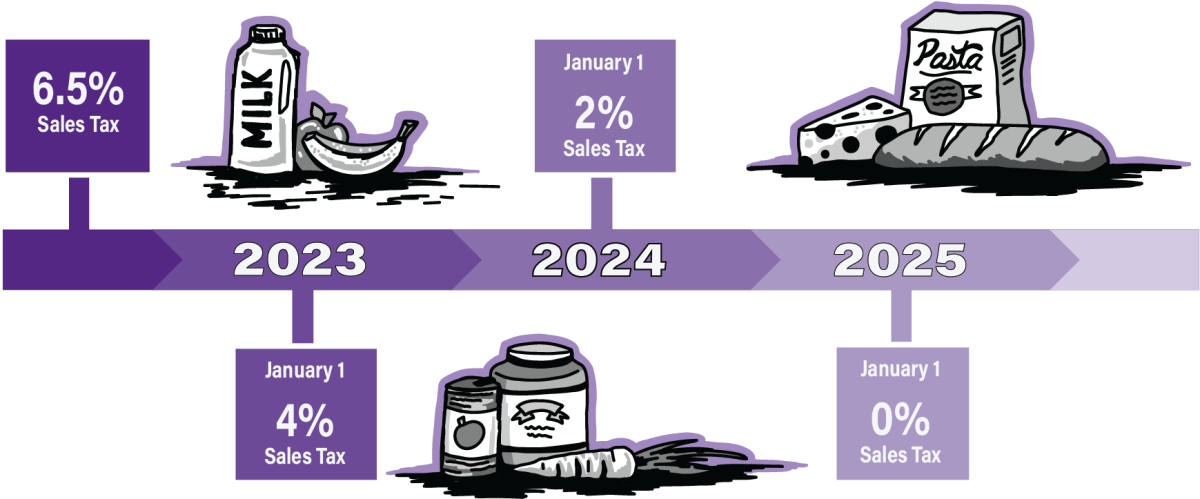

State sales tax on food in Kansas will reduce to 0% by Jan. 1, 2025 — a process which began in 2023 in accordance with House Bill 2106.

According to a publication by the Kansas Department of Revenue, Kansas legislature reduced food tax from 6.5% to 4% in January 2023, to 2% in January 2024 and will eliminate it completely on Jan. 1, 2025.

Kansas Gov. Laura Kelly said this tax reduction is “a win for the Kansas people.”

“All people have been talking about for the past two years or so has been inflation and particularly the cost of food,” Kelly said. “Now that’s waning, coming down quite significantly, but by eliminating the sales tax on food — you take a 6.5% reduction in the cost of food for people — that makes a huge difference to many, many people. Now I think we calculated that the average family of four would save over $500 a year, just on sales tax elimination.”

Daniel Kuester, director of undergraduate studies in economics at Kansas State, said this bill is especially impactful to low-income individuals.

“I personally look at this as more of a way to remove what is, in essence, a regressive tax,” Kuester said. “Because the people with the least amount of income pay the highest percentage of their income on sales tax, particularly those on things like groceries.”

Basil Knight, junior in music education, said saving money on groceries would allow them to make more meals instead of eating fast food.

“It’s so hard, with groceries being so expensive, to be able to afford getting enough for three meals a day, and so I’m just like, ‘I’m gonna go to McDonald’s, because it’s cheaper,’” Knight said. “But now knowing that there won’t be taxes on it [groceries], it’ll be less expensive and I won’t have to waste so much money eating out all the time.”

According to the KDOR, the food sales tax elimination applies to “food and food ingredients, and certain prepared food.”

“Instead of going to a restaurant and getting a steak, french fries and broccoli you can get it packaged for you at Dillon’s,” Kelly said. “I think those kinds of foods are not subject to the sales tax elimination … whereas if you bought those ingredients, if you bought the steak, the potatoes and the broccoli separately you would not pay sales tax.”

Kuester said an elimination of sales tax doesn’t mean Kansans won’t pay any taxes on food at all.

“The City of Manhattan has a sales tax,” Kuester said “… Most cities — usually it’s going to be a city, it could be a county — is going to have their own sales tax. Obviously the state typically doesn’t control those.”

Kelly said she talked with many Kansans for public input on the food sales tax reduction.

“[I had] lots and lots of conversations with folks,” Kelly said. “In fact, I did a sort of around-the-state tour when we posed to ax the sales tax, so I heard from lots and lots of people about how much they would appreciate the elimination of that sales tax. … I know people are very pleased that we did what we did.”

Knight said the tax reduction creates a domino effect which helps students in other areas.

“We need to eat to survive, and we need to eat to fuel our brains to learn,” Knight said. “If we don’t do well in classes because we’re not getting food then we’re failing the class and we have to spend even more money to take that class again and get a better grade. We need easier access to food to fuel our brains and bodies.”

Kelly said she originally wanted to implement a total reduction of food sales tax in 2023.

“Reportedly, the legislature was trying to be fiscally conservative and phase it in rather than one fell swoop,” Kelly said. “The reality, though, is that if that were really the reason then they wouldn’t have given me such a hard time on the income tax and social security reductions, you know, where I wanted to be much more conservative on the total impact of the bill. So I think it really, honestly, had more to do with politics than anything else. Giving me the full sales tax elimination all at once, I think they felt would be too much of a political win for me.”

Kuester said a gradual tax reduction may have helped Kansas keep a balanced budget.

“We had the Brownback tax cuts on income tax that were a pretty big shock to the budget and the economy, and some people may be wary of having a sudden change like that,” Kuester said. “I would suppose that that’s probably the most logical explanation [for a gradual reduction], is that you are able to better respond to this change by generating other revenues or cutting spending if it’s done gradually.”

Kelly said she doesn’t foresee any negative repercussions resulting from the bill.

“Clearly it’s a very significant reduction in the revenues coming into the state, but I think that’s been offset by the incredible economic growth that we’ve experienced over the last five-and-a-half years,” Kelly said. “We’ve been able to attract $20 billion in new capital investment, 68,000 new jobs — what all that means is that you’re basically broadening your tax base so that we have more people working in the state of Kansas at better paying jobs and contributing to the state’s commerce through their income tax.”

Kelly said she aims to reduce taxes in other areas for Kansans.

“We really need to revisit the idea of eliminating sales tax on feminine hygiene products and diapers,” Kelly said. “… I’m asking legislators to hold off on making any more tax cut proposals until we experience the full impact of what we did last year and full impact of the total elimination of food sales tax, so I think maybe legislative session of ‘26 we can look and see how the numbers are and whether or not we can address some of the leftover issues.”

Jeff G • Oct 3, 2024 at 12:52 pm

Do you really have to wait more than a year to help women with their feminine hygiene products and diapers. Two of the most overpriced products on the market. The impact surely wound be minimal compared to the food tax reduction.

Josh • Oct 14, 2024 at 12:55 pm

The Governor has signed tax cuts totaling over $1 billion per year when you count 2022 tax cuts, and the tax cuts passed in 2024. Not only that, because of her leadership, it was focused on tax cuts that benefit all Kansans across the board and not just on those who make the most already.

She tried to push for the tax cuts that you’ve identified, but she’s a very fiscally responsible leader, having been the chief negotiator for Democrats during the Brownback years. Once all the new tax cuts have fully taken effect next year (on groceries, on social security benefits, on income taxes, and on property taxes), she’s more than justified in calling for a pause to allow the state to determine the true impact of these historic tax cuts.