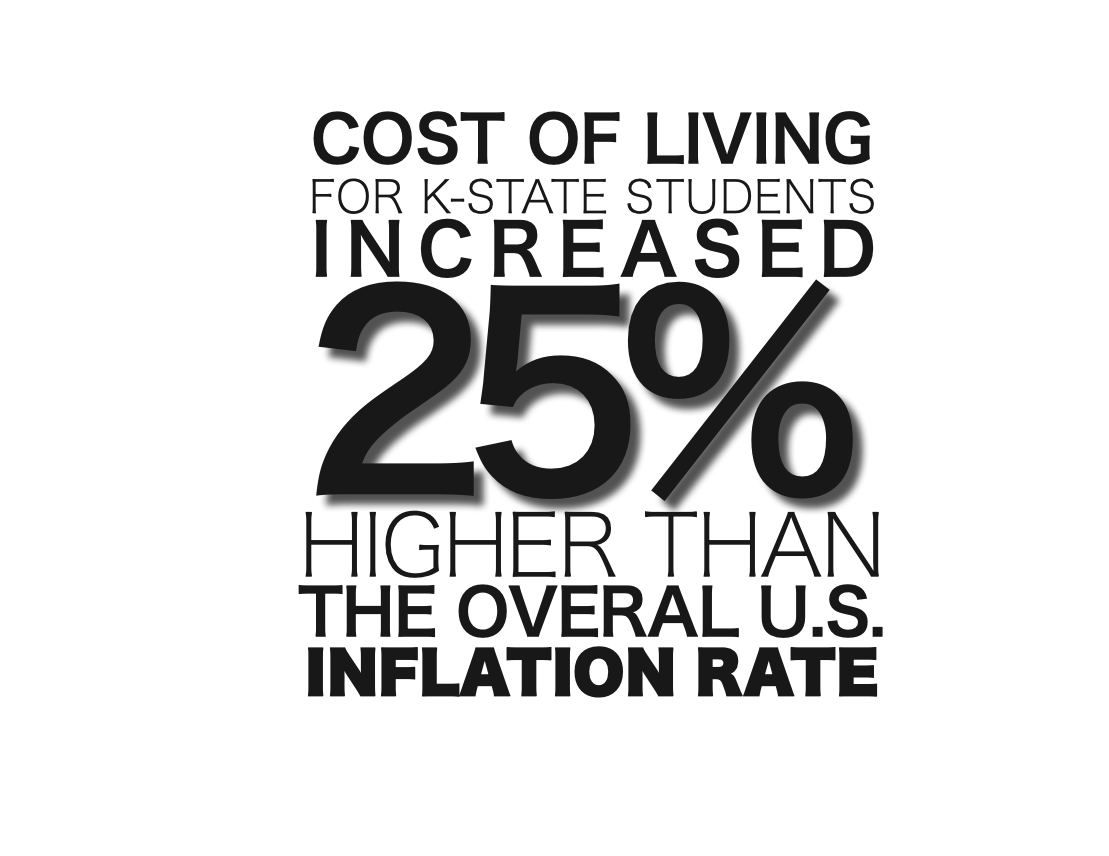

The Kansas State Economics Club conducted research on the Student Price Index for 2025 and found that the average cost of living for K-State students is 25% higher than the average U.S. citizen.

The SPI increased by 3.6% from last year, according to their report, while the Consumer Price Index has increased by 3% as of Oct. 24, according to the U.S. Bureau of Labor Statistics.

“The Student Price Index is meant to mimic the Consumer Price Index, which is a measurement of inflation for the entire United States,” Landon DiLeonardo, senior finance major and vice president of the economics club, said. “We perform our analysis very similarly by looking at a basket of goods that are more typical for your average college student. After that, we bring all the data together and calculate the change in prices year over year, and then compare it to the inflation amongst the entire U.S.”

The “basket of goods” used to determine the SPI included housing, tuition, textbooks, internet, gas, groceries, movie tickets, beer, pizza and ICAT tickets.

“We go around Manhattan and record prices,” Jacob Hoffman, senior in economics and president of the economics club, said. “… We went to Dillons and recorded the price of several groceries, [and] we went to gas stations. … What makes the SPI special is that it tracks the prices of goods catered to college students, so we went to Aggieville and found the price of a pitcher of beer. So, it’s a collection of in-person data gathering.”

Dr. Dan Kuester, director of undergraduate studies in economics, said this project began at K-State in 2002 and has since become an annual tradition for the economics club. Kuester inherited the project when he started at K-State in 2004.

“Some of the prices collected for the SPI were unchanged, like beer, pizza and ICAT tickets,” Kuester said. “Tuition was up 3.5%, almost identical to the overall change in the price index, and that makes up 32% of the bundle. Housing, fortunately, was only up 2.7%.”

Kuester said that the biggest levels of inflation occurred in textbooks, internet and groceries, as those were up by 12%, 10% and 7%, respectively. Most other items have settled at a 3-5% increase.

“If I had to guess, if it’s going one way or the other, I think we may be headed for a little bit of a higher inflation as some pressures from higher input costs, due to things like tariffs, flow their way through the economy,” Kuester said. “I do think these tariffs are starting to have an impact on consumer goods. It’s hard to say what will happen with tuition, but we’re being very competitive and trying to be very thoughtful about keeping those prices low.”

Andrea Spaid, freshman in psychology and criminology, said paying for school isn’t getting easier.

“I think students are affected more because we pay a lot for housing, tuition and other school-related costs,” Spaid said.

Sophia Ong, senior in dietetics and a member of the economics club, said high demand for housing at K-State can explain the increase in housing prices.

“What we saw is that there was an increase in off-campus housing and the dorms’ pricing due to the increase in the new student population, especially this year, we saw one of the biggest classes,” Ong said. “We’ve seen in the last two years they’ve had to reopen older dorms like Boyd and Putnam. … I’d say that’s a big factor, as well as new developments. … Having higher value in a place of living will make it more expensive.”

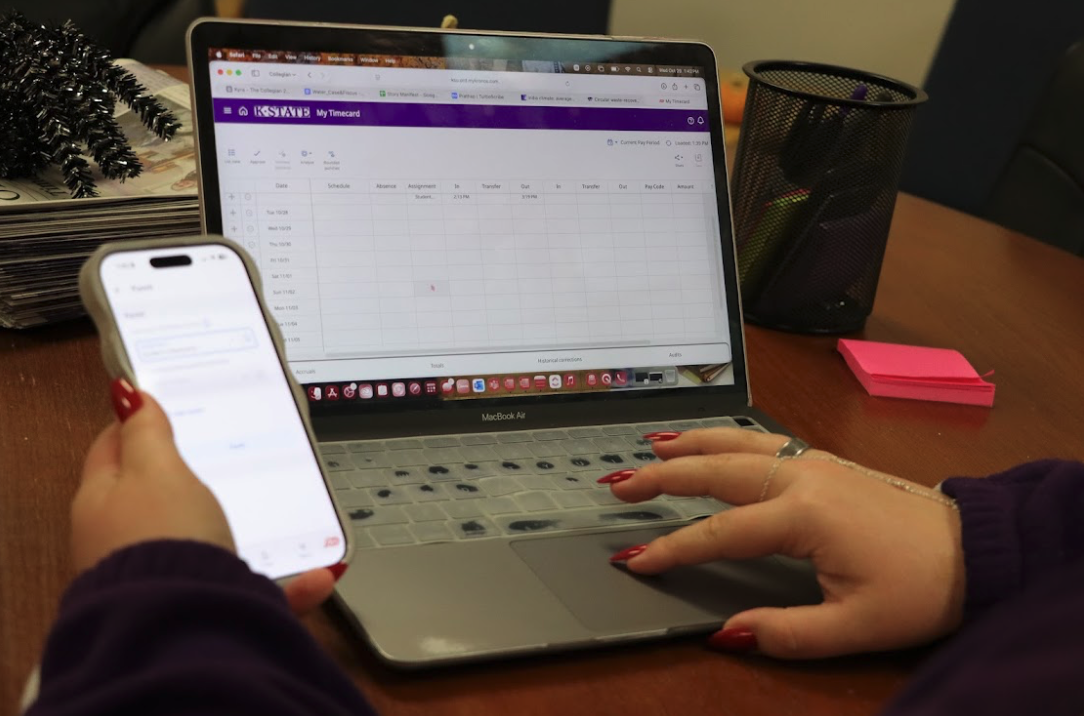

A higher cost of living is something many students, like Spaid, have to navigate by working while going to school.

“I do feel that keeping up with expenses every week and still having money aside for activities is difficult, especially since many students, including myself, have to juggle working and school,” Spaid said.